Toronto, September 16th, 2025 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) announces that it has initiated a non-brokered private placement of up to 50,000,000 units at a price of $0.20 per unit for gross proceeds up to $10,000,000 (“Private Placement”). The Company has secured an initial lead order from strategic partner Ocean Partners Holdings Limited, an international metals trader of up to $8,000,000.

Simon Quick, CEO of Canadian Copper, stated,

“Junior mining companies need strong local, governmental, technical, and financial partners to convert development projects into producing mines. We are incredibly fortunate to have Ocean Partners involved this early in Canadian Copper and for their significant participation in this financing. Our focus is now on developing a new Canadian critical metal operation by purchasing the only permitted mill and tailings site, with access to a deep-water port in the province.”

Brent Omland, CEO of Ocean Partners, stated, “We are very pleased to be partnering with Simon and the Canadian Copper team to advance the development of the Murray Brook project. The acquisition of the Caribou Processing Complex will allow the project to be rapidly advance to production and we are delighted to be a part of the revitalization of mining activities in the prolific Bathurst camp.”

Chief Terry Richardson, Pabineau First Nation, commented, “We in Pabineau First Nation are excited to see mining in the province and region gain interest. With the engagement with First Nations and the opportunities that we see coming for the region, and First Nations, this should ensure economic prosperity for all. Mining is not new to our area, and as long as our four pillars are kept in balance of Cultural, Social, Environmental and Economic, we support projects in our area.”

Purpose of the Private Placement and Use of Funds

The Company plans to use the proceeds to complete the previously announced Caribou Processing Complex transaction (“Caribou”) in addition to advancing certain key development activities addressed in the June 2025 Preliminary Economic Assessment, such as:

- Complete the remaining $6M payment to satisfy the Caribou transaction. Customary closing conditions such as Mining Lease transfer and other items should occur in Q4, 2025.

- Complete necessary environmental baseline studies this year prior to submitting the Environmental Impact Assessment (“EIA”) in H1, 2026.

- Initiate a 1,000-meter metallurgical drill program and testwork to refine process plant operating costs and recovery performance. Permits for this work have already been submitted and the testwork program is designed.

- Identify engineering design requirements associated with the Murray Brook deposit that are necessary for provincial construction and operating permits. The Caribou Process Complex is approved and maintains all required operating permits.

Caribou Plant Turnover Activities Update

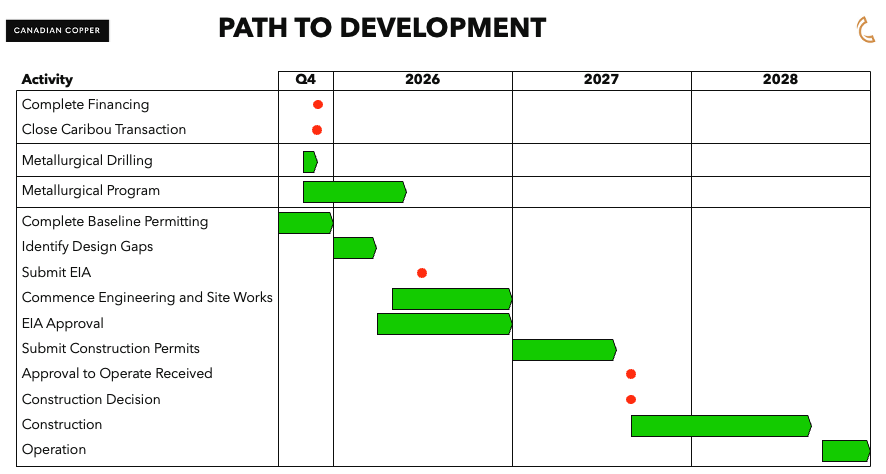

The Company has identified key personnel with extensive Caribou maintenance, operating, and environmental compliance experience still living in the Bathurst area. We expect this collective team will join Canadian Copper during the Caribou handover activities to occur in Q4, 2025. Further, the Company is interviewing Chief Operating Officer candidates concurrently to manage the development and execution of the preliminary engineering, permitting, and construction schedule shown below in Table A.

Table A: Estimated Schedule of Activities

Private Placement Details

Simon Quick CEO of Canadian Copper has committed $25,000 to this offering, increasing his after-tax investment to $350,000 to date.

Each unit of the Private Placement will consist of one common share of the Company and one ½ share purchase warrant. The warrant is one ½ warrant with a twelve-month expiry and an exercise price of $0.25. The warrant will be subjected to an accelerated exercise clause in the event the Company’s share price exceeds $0.30 for ten consecutive trading days on a volume weighted average price basis.

Closing is expected on or about November 12th, 2025, or such other date as the Company may determine. While the Private Placement is being offered by the Company on a non-brokered basis, the Company may pay finder’s fees to arm’s-length third parties consisting of a cash commission of up to 7% of the gross proceeds of the Private Placement and 7% broker warrants on the same terms as warrants issued per the Private Placement.

A statutory four month plus one day hold period will apply to all securities issued in connection with the Private Placement. The Private Placement is subject to CSE and regulatory approval.This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities in the United States nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or any state securities laws and may not be offered or sold in the United States unless registered under the 1933 Act and any applicable securities laws of any state of the United States or where an applicable exemption from the registration requirements is available.

CSE Shareholder Approval Requirements

CSE policies require shareholder approval for any transaction that would materially affect control of the Company. Ocean Partners currently owns approximately 5,000,000 shares or 4.7% of the issued and outstanding shares of the Company. With Ocean Partners lead order of $8,000,000 or 40,000,000 shares, Ocean Partners will become a “Control Person” as defined by the CSE and applicable securities law, holding approximately 29% of all the issued and outstanding shares of the Company upon completion of the Private Placement.

Ocean Partners is also a person closely associated with Brent Omland, a Director of Canadian Copper. Mr. Omland is Chief Executive Officer of Ocean Partners and holds a minority stake in, and is a director of, Ocean Partners’ parent entity.

Ocean Partners’ participation in the Private Placement will require minority shareholder approval.

Multilateral Instrument 61-101 – Protection of Minority Security Holders (“MI 61-101”)

The Company is exempt from the requirements of MI 61-101 to obtain a formal valuation and minority shareholder approval in connection with the Private Placement with Ocean Partners in reliance on section 5.5(c) of MI 61-101.

Specifically, the Private Placement is a distribution of securities for cash and neither the Company, Ocean Partners or Brent Omland have knowledge of any material information concerning the Company or its securities that has not been generally disclosed.

The Company is required to obtain minority shareholder approval for Ocean Partners’ participation in the Private Placement by a majority of “disinterested shareholders” as defined in MI 61-101. Additionally, pursuant to policies of the CSE, the Private Placement with respect to Ocean Partners is being treated as a “non-arm’s length” transaction, and will also require shareholder approval by a majority of “disinterested shareholders” as defined in MI 61-101.

Notice of Special Meeting of Shareholders

The Company has called for a Special Meeting of its Shareholders to consider, among other things, Ocean Partners’ participation in the Private Placement resulting in Ocean Partners becoming a Control Person, to be held on November 10th, 2025 at 11:00 a.m. (Toronto time). Shareholders of record at the close of business at 5:00 p.m. (Toronto time) on September 23, 2025 will be entitled to vote at the meeting.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration and development company with defined copper and other base metals resources. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada. There are currently 105,031,836 shares issued and outstanding in the Company.