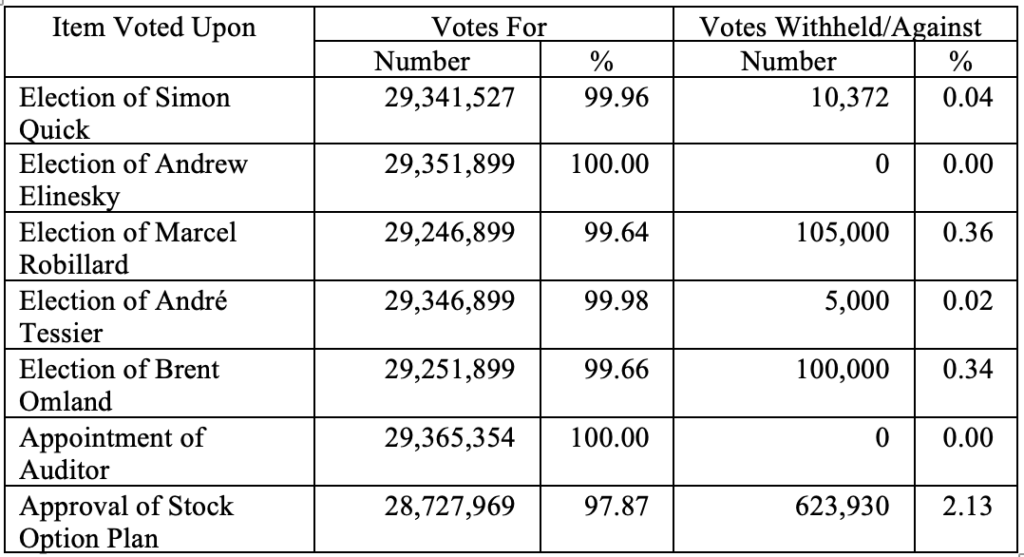

Toronto, March 4th, 2025 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) announces voting results from the Company’s Annual General and Special Meeting of the Shareholders held on February 18, 2025. A total of 29,365,354 common shares were voted, representing 28.71% of all outstanding common shares of the Company.

A summary of the results of the election of the Company’s directors is as follows:

Canadian Copper further reports that pursuant to its stock option plan, it has granted 2,400,000 stock options to directors, officers, employees, and consultants of the Company at an exercise price of $0.22 per common share to vest quarterly over an 18-month period and expire on March 3, 2027.

Simon Quick, CEO of the Company, stated,

“This is Canadian Copper’s first stock option grant since being a public company public in 2022. Further, the Company has priced these option units at a premium to the current market price in an effort to respect our current and future investors that support us. This grant is designed to reward and incentivize certain key individuals for their past contributions to Canadian Copper and their current efforts linked to the successful financing and closing of the Caribou Complex transaction.

The Company relied on sections 5.5 (a) and (b) and 5.7(1)(a) and (b) of MI 61-101 as the exemption from the minority approval requirements of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions MI 61-101 in respect of the grant of stock options to the directors of the Company as neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the grant of the options to the director of the Company exceeded 25% of the Company’s market capitalization.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada. There are currently 102,271,319 shares issued and outstanding in the Company.