Toronto, April 15, 2025 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) announces that it has closed its non-brokered, flow-through share offering (the “FT Offering”) consisting of 2,710,517 flow-through shares (the “FT Shares“) of the Company at a price of C$0.19 per FT Share for aggregate gross proceeds of $515,000. There were no warrants as part of this financing.

Simon Quick, CEO of Canadian Copper, stated,

“We would like to simultaneously thank and welcome a new small group of strategic shareholders to Canadian Copper. This flow-through placement did not utilize a flow-through fund, and these investors share our view that the Bathurst Camp of New Brunswick remains both prospective for exploration and is also a top tier jurisdiction to develop new Canadian mines. With this raise now closed, we are excited to start working on the Murray Brook East property.”

The Notice of Planned Work (“NPW”) was submitted to the New Brunswick Government on April 8th, 2025. The current program will consist of:

- Prospecting and geologic mapping;

- Excavation of up to 14 trenches ranging from 2 – 20 meters wide by 50 – 300 meters long;

- Several near surface drill holes to test known geochemical and geophysical targets.

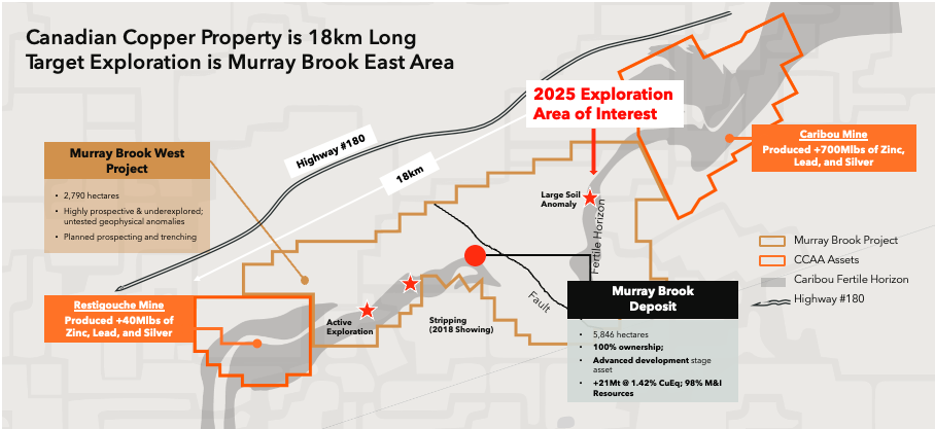

The purpose and use for this proposed funding are to advance the Murray Brook East Project which is located between the Murray Brook deposit and the Caribou Complex (Figure A). The program will start in Q2 2025 and include prospecting, trenching and drilling activity. Murray Brook East has a minimum spend requirement of ~$140,000 per year to maintain its good standing status. Our budgeted figure of ~$500,000 will satisfy carry over holding expenses because of Canadian Copper’s transaction with Votorantim Metals Canada.

The proceeds of the FT Offering will be used to incur eligible “Canadian exploration expenses” that qualify as “flow-through critical mineral mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures“) related to the Company’s projects in New Brunswick, Canada. The Company plans to incur Qualifying Expenditures on or before December 31, 2026 (or such other period as may be permissible under applicable tax legislation), and to renounce all the Qualifying Expenditures in favour of the subscribers of the FT Shares effective December 31, 2025. The Company paid 6% in finders fees associated with the FT Offering.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities in the United States nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or any state securities laws and may not be offered or sold in the United States unless registered under the 1933 Act and any applicable securities laws of any state of the United States or an applicable exemption from the registration requirements is available.

Figure A: Murray Brook East Location