Toronto, September 10th, 2024 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) announced today the approval of a second extension for the Initial Public Offering (“IPO”) of Raptor Resources Ltd. (“Raptor”) and listing on the Australian Securities Exchange (“ASX”). Under the terms of the second extension, Raptor will transfer the Company a non-refundable advanced payment of $50,000 and is required to complete their IPO on or before September 27th, 2024.

Next Steps and Accelerated Cash Payment of Turgeon Project

Under the updated Sale Agreement, Raptor is required to complete their IPO on the ASX by September 27th, 2024 (“End Date”), make a cash payment (“the Payment”) totaling $945,0001, and issue 4,000,0002 Raptor shares to Canadian Copper. The IPO milestone cash payment component of this transaction has accelerated from the original $675,0001 payment to $945,0001. This modification was required by the ASX as a listing condition attached to the Turgeon Project Sale Agreement.

“An entrepreneurial spirit, teamwork, and flexibility are essential in the junior mining business. Canadian Copper recognizes the hard work to date and commitment by the Raptor Team to satisfy the terms of this transaction. Subject to closing of the Raptor IPO, this non-core asset sale will represent a significant contribution of non-dilutive capital to the Company.” Simon Quick, CEO of Canadian Copper.

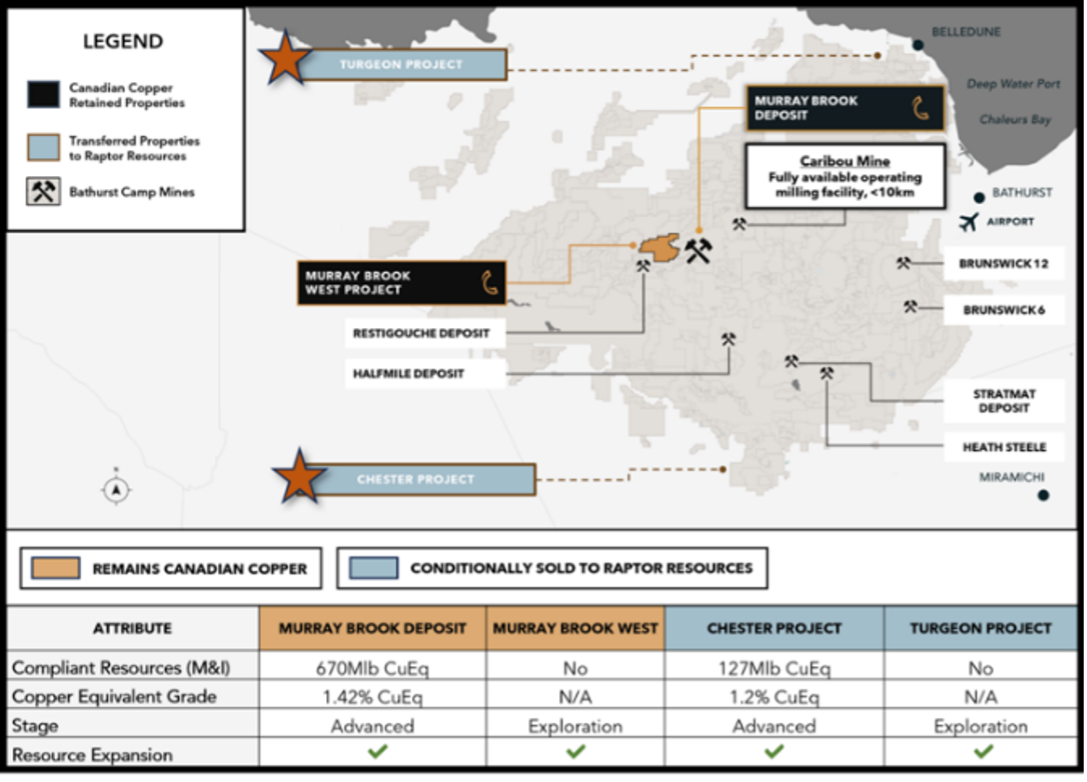

Figure A: Asset Sale Map

[1] CAD Exchange Rate (AUD:CAD) 0.9

[2] ASX listing rules mandate a minimum issue price of $0.20 per share. Consideration value assumes a $0.20 price per share and CAD Exchange Rate (AUD:CAD) 0.9. https://www.asx.com.au/about/regulation/rules-guidance-notes-and-waivers/asx-listing-rules-guidance-notes-and-waivers

Qualified Person

Mr. Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc. and independent Qualified Person as defined in NI 43-101. Mr. Puritch is responsible for the Murray Brook MRE and has reviewed and approved the scientific and technical content of this news release.

Mr. Michael Dufresne, M.Sc., P.Geol., P.Geo. is President and a Principal of APEX Geoscience Ltd. and is an independent QP. Mr. Dufresne is responsible for the Chester MRE and has reviewed and approved the geological information reported in this news release.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada. There are currently 90,044,762 shares issued and outstanding in the Company.