Accelerating Timeline to Potential Cu-Zn-Pb-Ag Production at the 100%-owned Murray Brook Deposit: PEA Planned for H1 2025

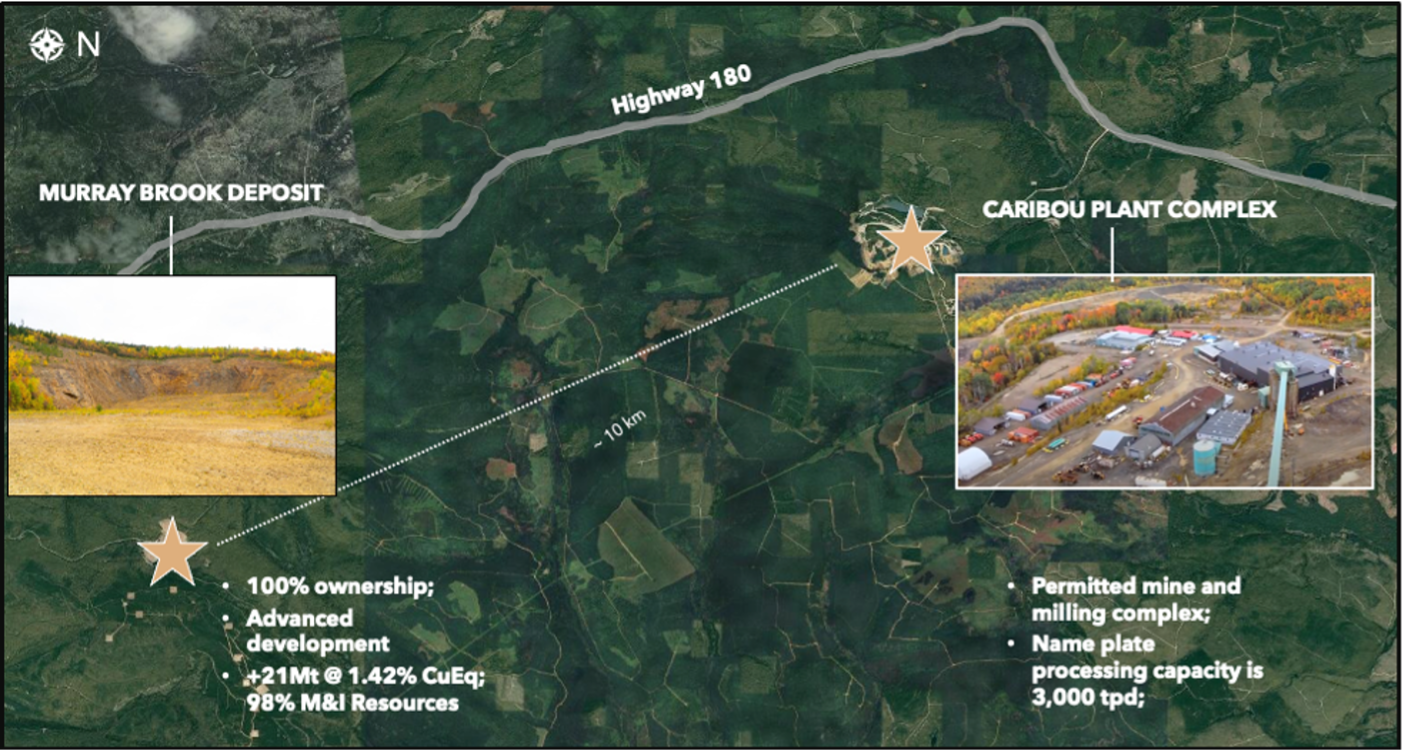

Toronto, October 28th, 2024 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) announced today the signing of a Term Sheet (“Term Sheet”) and Exclusivity Agreement (“Exclusivity Agreement”) providing the Company the exclusive right to acquire the Caribou Processing Plant Complex (“Caribou Complex”). The transaction represents a material acceleration and derisking step in bringing the Murray Brook Cu-Zn-Pb-Ag deposit to production.

Transaction Highlights

Purchase Price: $6,225,000.

Term Sheet Signature Date: October 28th, 2024.

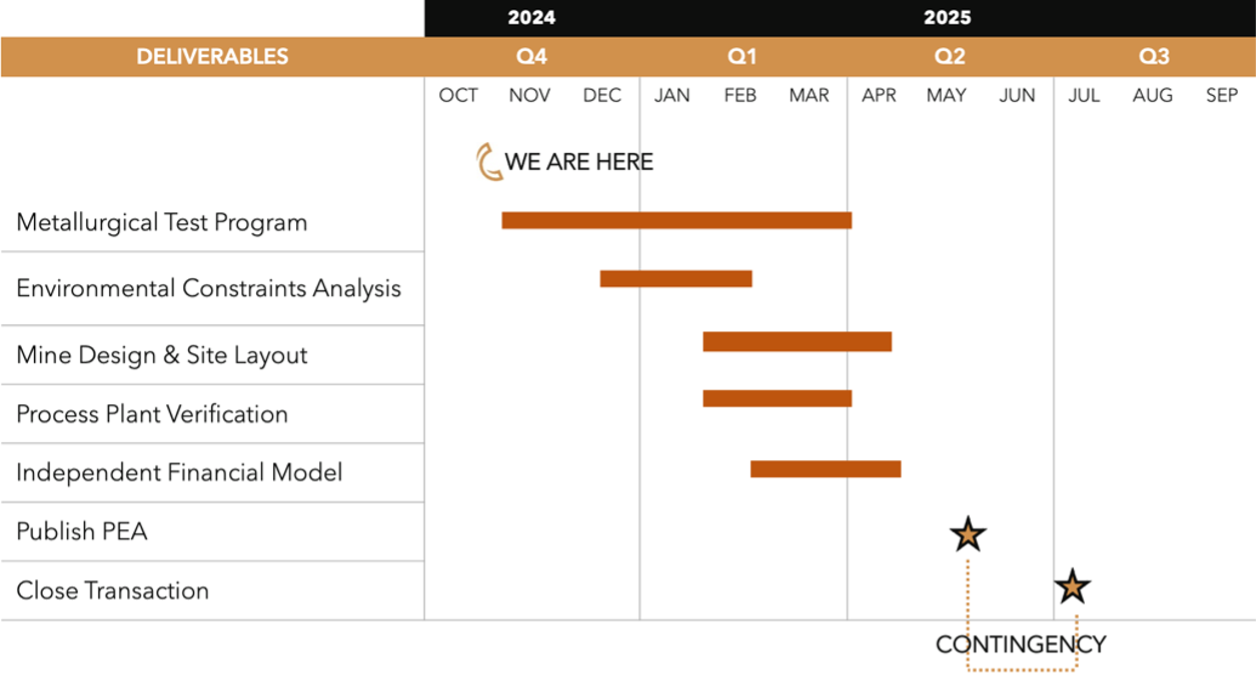

Transaction Closing Date: July 11th, 2025.

Deposit: $225,000 of which $125,000 is refundable against purchase price.

The Caribou Complex: Includes a 3,000 tonne per day (“tpd”) milling facility consisting of a primary grinding circuit with one SAG mill and one ball mill, two regrinding circuits with three ISAmills and one ball mill, a differential sulphide flotation plant and associated reagents preparation and addition systems, metallurgical and geochemical laboratories, a tailings management facility, an underground mine with a historical Proven and Probable 4.5 million tonnes[1] (“Mt”) Reserves, and other infrastructure such as connected grid power and water supply for operations. The New Brunswick government has managed Care and Maintenance for the site since January 2023. Caribou operated until August 2022 at which point a Concentrator Care and Maintenance shutdown occurred by the previous operator. Please click for drone footage.

Simon Quick, CEO of Canadian Copper.

“The proposed transaction creates important synergies for Canadian Copper. By integrating our large Murray Brook deposit with an already permitted and constructed Caribou Complex that operated as recently as August 2022, we aim to significantly reduce the schedule, capital cost, and permitting time required to produce copper, zinc, and lead concentrate from Murray Brook. The combination of a large open pit polymetallic Mineral Resource with a nearby processing plant represents a material acceleration and derisking effort to create a new leader in critical metals production in Eastern Canada.”

Next Steps

The Company and several consultants completed a Caribou Complex audit October 2nd, 2024. The Company has also engaged three groups responsible for the design, development, and processing of the Murray Brook deposit at the Caribou Complex under the combined operation strategy (“Combined Operation”). These Qualified Persons’ primary objectives are to verify the internal Company’s estimates of the Combined Operation which will be the basis for publishing a Preliminary Economic Assessment (“PEA”) in the first half of 2025.

Engineering contracts have been awarded to:

- Ausenco Engineering Canada ULC (“Ausenco”): A globally recognized engineering firm focused on copper and polymetallic development projects. Ausenco is responsible for process plant validation, identification of optimization opportunities, capital and operational cost estimates, as well as financial model preparation for the Combined Operation plan.

- Pierre Lacombe P. Eng.: A +40-year base metal mineral processing expert, most recently Group Metallurgist for Lundin Mining Corporation. As an Owners Representative to the Company, Mr. Lacombe is to advance the planning, supervise, and lead all metallurgical testwork, review current plant design and optimization related activities required to process the Murray Brook mineralized material through the constructed Caribou Complex under the Combined Operation plan.

- P&E Mining Consultants Inc.: Responsible for Mineral Resource modeling, mine design, haul route trade-off analysis, and all general site layout activities required to deliver material under the Combined Operation.

Table A: Schedule of Activities for the Combined Strategy

Funding Strategy

The Company is advancing several financing options to fund both the purchase price and additional development capital required to advance the Combined Operation through the engineering and provincial permitting stages. As the financial model and PEA progress in Q1 2025, the Company will solicit parties to participate in a competitive financing process.

To date, discussions include:

- Offtake financing;

- Royalty and precious metal stream opportunities;

- Canada Infrastructure Bank funding;

- Multiple options within Natural Resources Canada (“NRCan”) and their Critical Minerals Infrastructure Fund (“CMIF”);

- Partnerships with strategic investors;

- Surety bond providers;

- Project financing debt; and,

Future Reclamation Liabilities: $6,200,000[2]. The Company is in discussions with surety bond providers to minimize cash attributed to this requirement. Further, future long-term water treatment for closure liabilities exist that are separate from the above that are pending further discussion with the New Brunswick government. The Company is exploring design modifications to substitute the water treatment plans and substitute this solution for a closure dam that will both increase tailings capacity for mine operations as well as act as a closure solution.

[1] Trevali Mining Corporation – Caribou Technical Report 2018

Figure A: Location Map of Murray Brook and Caribou Processing Complex

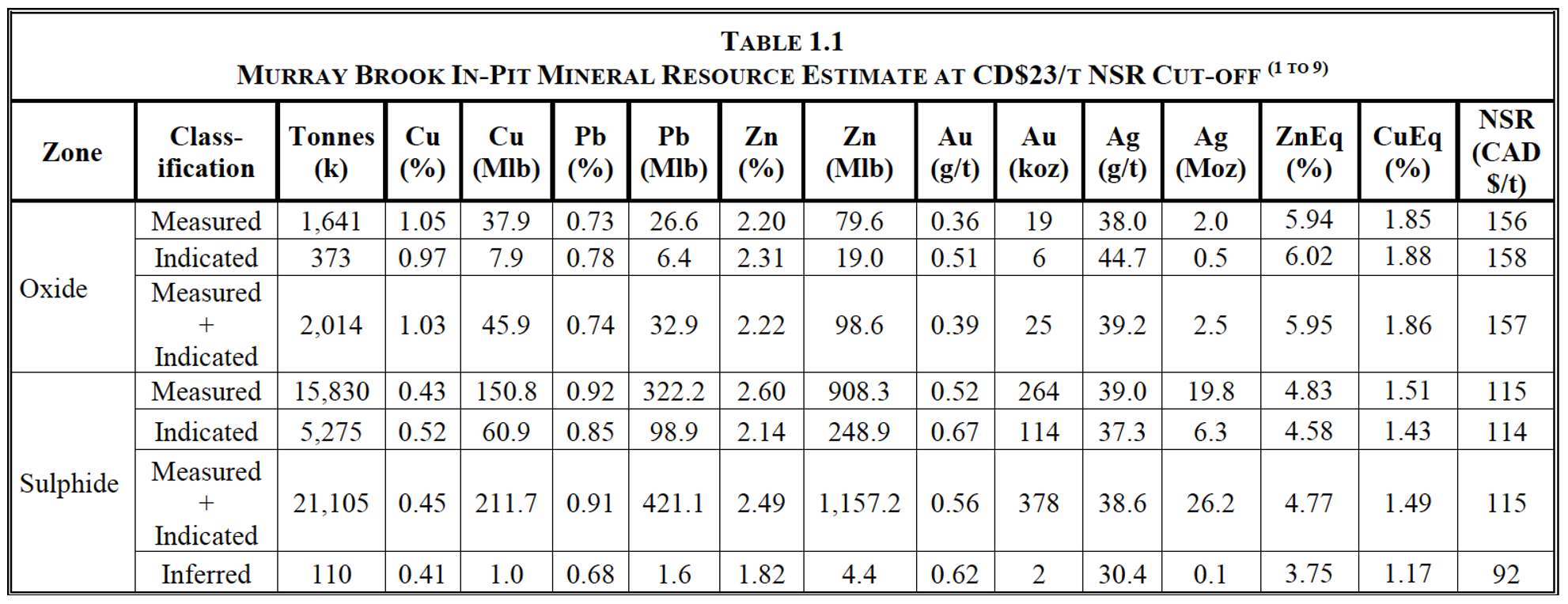

Mineral Resource Estimate Completed by P&E Consultants Inc.

This MRE[3] for Murray Brook is based on data with an effective date of October 3, 2023.

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

The Mineral Resource Estimate was based on July 2023 approx. consensus economics forecast US$ metal prices of $4.00/lb Cu, $1.25/lb Zn, $0.95/lb Pb and $23/oz Ag at a $0.76 USD/CAD exchange rate.

Process recoveries used were 80% Cu, 87% Zn, 75% Pb and 90% Ag. Au was not recoverable.

Overburden, waste, and mineralized material mining costs per tonne mined were respectively $2.00, $2.25, and $2.50.

Processing and G&A costs per tonne processed were respectively $20 and $3.

Constraining pit shell slopes were 50 degrees.

Frequently Asked Questions (“FAQ”)?

Please click here for access to the FAQ’s.

Qualified Person

Mr. Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc. is an independent Qualified Person as defined in NI 43-101. Mr. Puritch is responsible for the Murray Brook MRE.

Disclosures Regarding the Caribou Complex

Trevali Mining Corporation issued a press release entitled “Trevali Reports 2020 Mineral Reserves and Resources; Increasing Mineral Reserves at Rosh Pinah and Caribou Mines” on March 31, 2021 and further indicated in its 2020 Annual Information Form filed on www.sedarplus.ca referencing The Caribou Underground Mine Mineral Reserve estimate prepared by an non-independent mine engineering consultants effective December 21, 2020. The Trevali Mining Corporation – NI 43-101 Technical Report entitled “Technical Report on the Caribou Mine, Bathurst, New Brunswick, Canada” dated May 31, 2018, effective December 31, 2017, prepared by Roscoe Postle Associates Inc, under the supervision of Torben Jensen, Ian T. Blakley, Tracey Jacquemin and Shaun C. Woods and filed on www.sedarplus.ca is the historical technical report on the Caribou Complex (the “Caribou Technical Report 2018”) Canadian Copper is not treating the historical” proven or probable reserve” as a “current resources estimate” or “mineral reserves”, as it has not taken steps to identify what work needs to be done to verify, upgrade or re-classify the historical “mineral reserve” using a qualified person.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada. There are currently 90,044,762 shares issued and outstanding in the Company.

[1] See “Disclosures Regarding the Caribou Complex” below.

[2] Trevali Mining Corporation – Caribou Technical Report 2018

[3] Canadian Copper Inc. “Technical Report and Updated Mineral Resource Estimate of the Murray Brook ZN-PB-CU-AG Project New Brunswick Canada” (effective October 3, 2023) prepared by P&E Mining Consultants Inc, and filed on www.sedarplus.ca