Toronto, November 12th, 2024 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) announces that it has initiated a non-brokered private placement of up to 10,000,000 units at a price of $0.15 per unit for gross proceeds up to $1,500,000 (“Private Placement”). The Company has secured an initial lead order from Ocean Partners Holdings Limited of $500,000. Simon Quick CEO of Canadian Copper has committed $100,000 to this offering.

Purpose of the Private Placement and Use of Funds

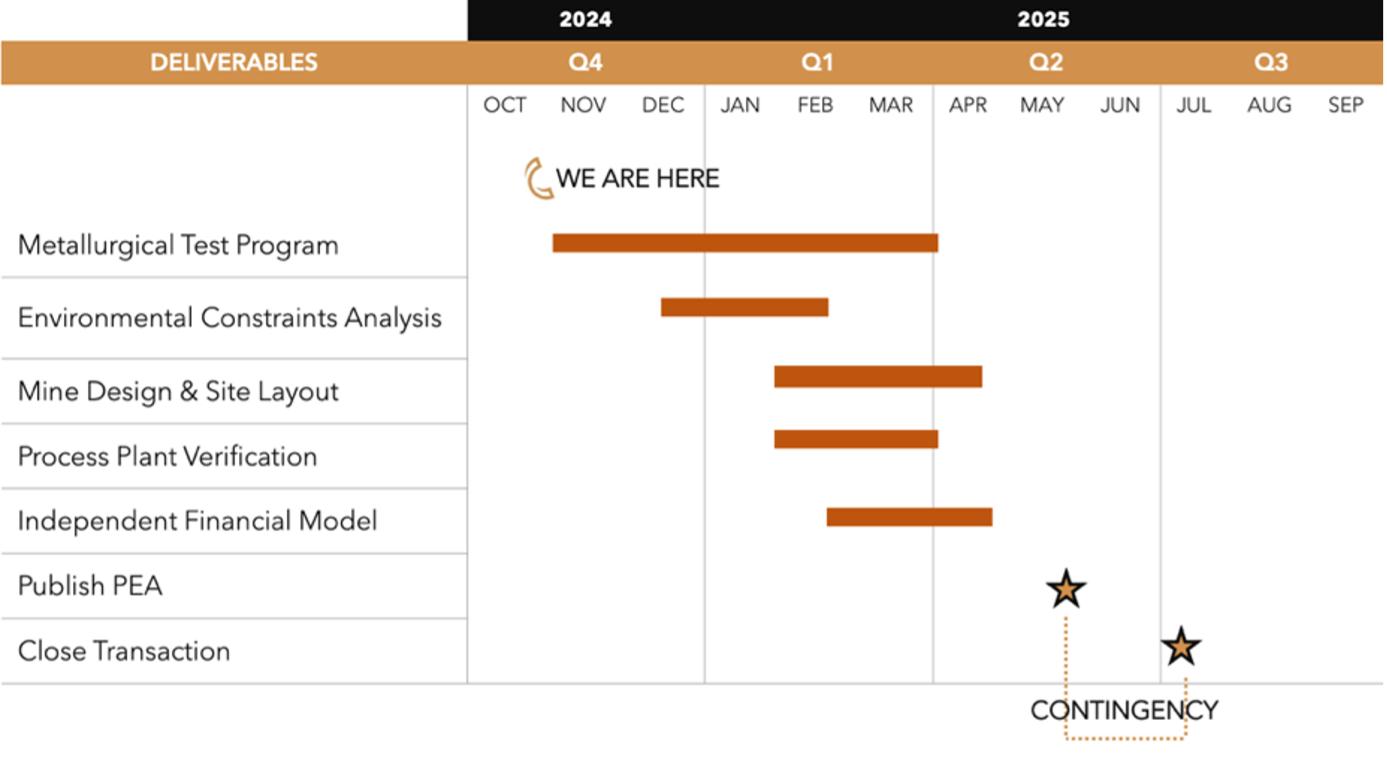

The Company plans to use the proceeds to complete the Preliminary Economic Assessment (“PEA”) that will analyze the economic potential of processing the Murray Brook deposit at the Caribou Complex under the Combined Scenario. The Company announced its proposed acquisition of the Caribou Process Plant Complex on October 28th, 2024. In this release, we stated several activities (see Table A) with anticipated completion dates that will culminate in a PEA targeted for the first half of 2025. For an updated Company presentation, please click here.

Progress Update

The Company has selected SGS Canada Inc. Lakefield (“SGS”) to complete the ~600-kilogram metallurgical program designed to complement the historical testwork already completed for the Murray Brook deposit. The primary objective of this testwork is confirm performance of the Murray Brook deposit material within the Caribou Process Complex. Composite samples simulating the early years of operation have been selected and will be delivered to SGS.

Table A: Schedule of Activities for the Combined Strategy

Government Related Funding Opportunities

On November 7th, 2024, the Company submitted its application for financial assistance and received acknowledgement of receipt from the Atlantic Canada Opportunities Agency (“ACOA”). There is no certainty in the approval of our request, but ACOA could contribute up to 50% of applicable costs related to certain qualifying PEA expenses. The Company continues to engage with the Canadian Government and related entities for possible critical mineral funding including Natural Resources Canada, Canadian Infrastructure Bank, Opportunities New Brunswick, and Export Development Canada.

Private Placement Details

Each unit of the Private Placement will consist of one common share of the Company and one-full share purchase warrant. The warrant is comprised of two distinct parts: one ½ warrant with a six-month expiry and an exercise price of $0.175 and one ½ warrant with a 24-month expiry and an exercise price of $0.225. The warrant with an exercise price of $0.225 will be subjected to an accelerated exercise clause in the event the Company’s share price exceeds $0.30 for 10 consecutive trading days on a volume weighted average price basis.

Closing is expected on or about November 29th, 2024, or such other date as the Company may determine. While the Private Placement is being offered by the Company on a non-brokered basis, the Company may pay finder’s fees to arm’s-length third parties consisting of a cash commission of up to 7% of the gross proceeds of the Private Placement and 7% broker warrants on the same terms as warrants issued per the Private Placement. A statutory four month plus one day hold period will apply to all securities issued in connection with the Private Placement. The Private Placement is subject to CSE and regulatory approval.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities in the United States nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or any state securities laws and may not be offered or sold in the United States unless registered under the 1933 Act and any applicable securities laws of any state of the United States or where an applicable exemption from the registration requirements is available.

Certain directors and other insiders of the Company may participate in the Private Placement and subscribe for an amount no more than the maximum amount permissible under applicable securities laws and regulatory rules. Participation by the directors and other insiders in the Private Placement would be considered a “related party transaction” pursuant to Multilateral Instrument 61- 101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company expects to be exempt from the requirements to obtain a formal valuation and minority shareholder approval in connection with the insiders’ participation in the Private Placement in reliance on sections 5.5(a) and 5.7(1)(a) of MI 61-101 in that the fair market value (as determined under MI 61-101) of any securities issued under the Private Placement (and the consideration paid to the Company therefor) to interested parties (as defined under MI 61-101) will not exceed 25% of the Company’s market capitalization (as determined under MI 61-101).

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration and development company with defined copper and other base metals resources. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada. There are currently 90,044,762 shares issued and outstanding in the Company.