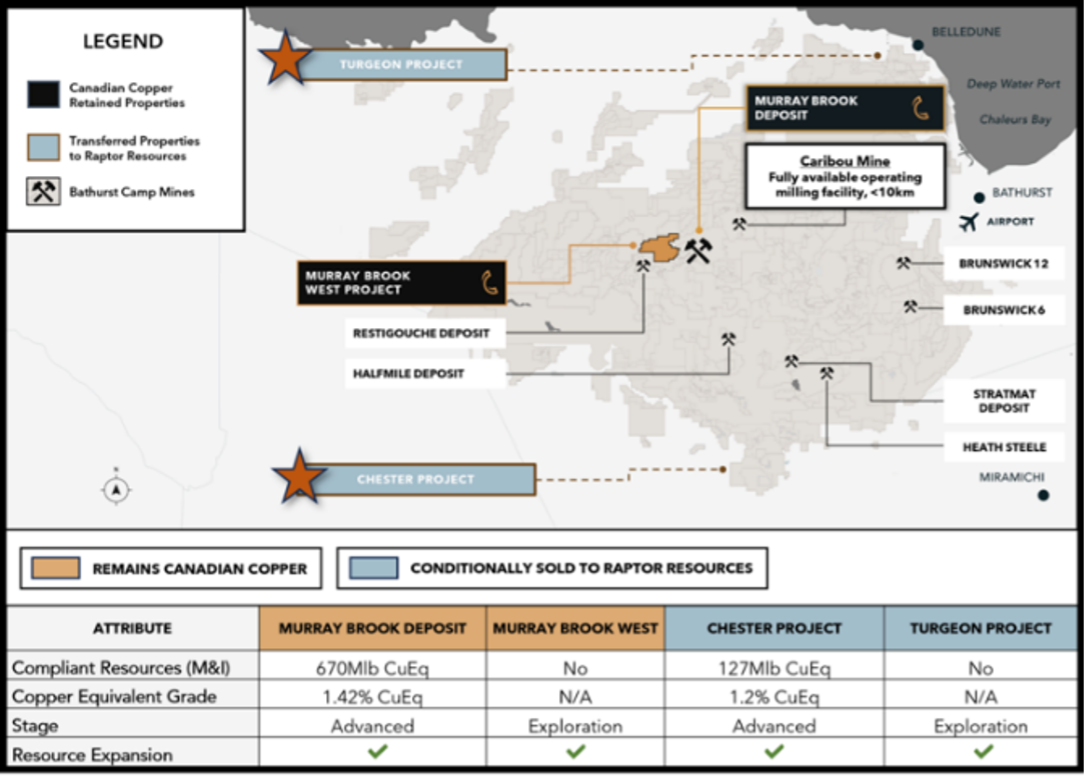

Toronto, July 2nd, 2024 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) announced today that the Initial Public Offering Prospectus for Raptor Resources Ltd. (“Raptor”) will be lodged with the Australian Securities Exchange (“ASX”) on or before of July 15, 2024. This transaction includes the sale and transfer of Canadian Copper’s Option Agreement rights for the Chester and Turgeon Projects (Figure A) located in New Brunswick, Canada, for total possible consideration of $2,160,0001,2 in cash and shares.

“The Team at Raptor is working diligently to complete their Initial Public Offering and listing on the ASX. Their financing is already committed, and they are preparing to commence drilling at the Chester Project immediately after listing on the ASX. Canadian Copper and Puma Exploration will support this extension request as we strongly believe in this partnership. The Bathurst Camp in New Brunswick is a prospective mining district, and it is important for all our stakeholders to see new investment and growing mining activity.” Simon Quick, CEO of Canadian Copper.

Next Steps and Timeline

Under the current Sale Agreement, Raptor is required to complete the listing of their Company shares on the ASX by June 30, 2024 (“End Date”), issue a cash payment (“the Payment”) totaling $675,0001, and issue 4,000,0002 Raptor shares to Canadian Copper. If this condition is not satisfied, Raptor may request a two-month extension by paying the Company $18,000 within 10 business days of the End Date. Raptor has requested this extension, and the Company has received the funds and approved the request. Raptor’s ASX share listing and Payment will be completed by August 30, 2024.

“Raptor Resource Ltd is looking forward to completing our Initial Public Offering and listing on the ASX. We are excited to commence drilling immediately after listing to advance the Chester Project and commence exploration activities on the Turgeon Project. We thank Canadian Copper and Puma Exploration for their support of the extension and look forward to building on our relationships.” Brett Wallace, Managing Director/CEO of Raptor Resource Ltd.

Figure A: Asset Sale Map

[1] CAD Exchange Rate (AUD:CAD) 0.9

[2] ASX listing rules mandate a minimum issue price of $0.20 per share. Consideration value assumes a $0.20 price per share and CAD Exchange Rate (AUD:CAD) 0.9. https://www.asx.com.au/about/regulation/rules-guidance-notes-and-waivers/asx-listing-rules-guidance-notes-and-waivers

Qualified Person

Mr. Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc. and independent Qualified Person as defined in NI 43-101. Mr. Puritch is responsible for the Murray Brook MRE and has reviewed and approved the scientific and technical content of this news release.

Mr. Michael Dufresne, M.Sc., P.Geol., P.Geo. is President and a Principal of APEX Geoscience Ltd. and is an independent QP. Mr. Dufresne is responsible for the Chester MRE and has reviewed and approved the geological information reported in this news release.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada. There are currently 90,044,762 shares issued and outstanding in the Company.