Toronto, June 13th, 2023 – Canadian Copper Inc. (CSE:CCI) (“Canadian Copper” or the “Company”) is pleased to announce that, pursuant to the terms of a Letter of Intent (“LOI”) it entered into with Votorantim Metals Canada Inc., an arm’s length seller (“VM Canada” or the “Seller”), it intends to acquire VM Canada’s entire 72% interest in the Murray Brook Joint Venture. Murray Brook is located in the Bathurst Camp of New Brunswick, Canada.

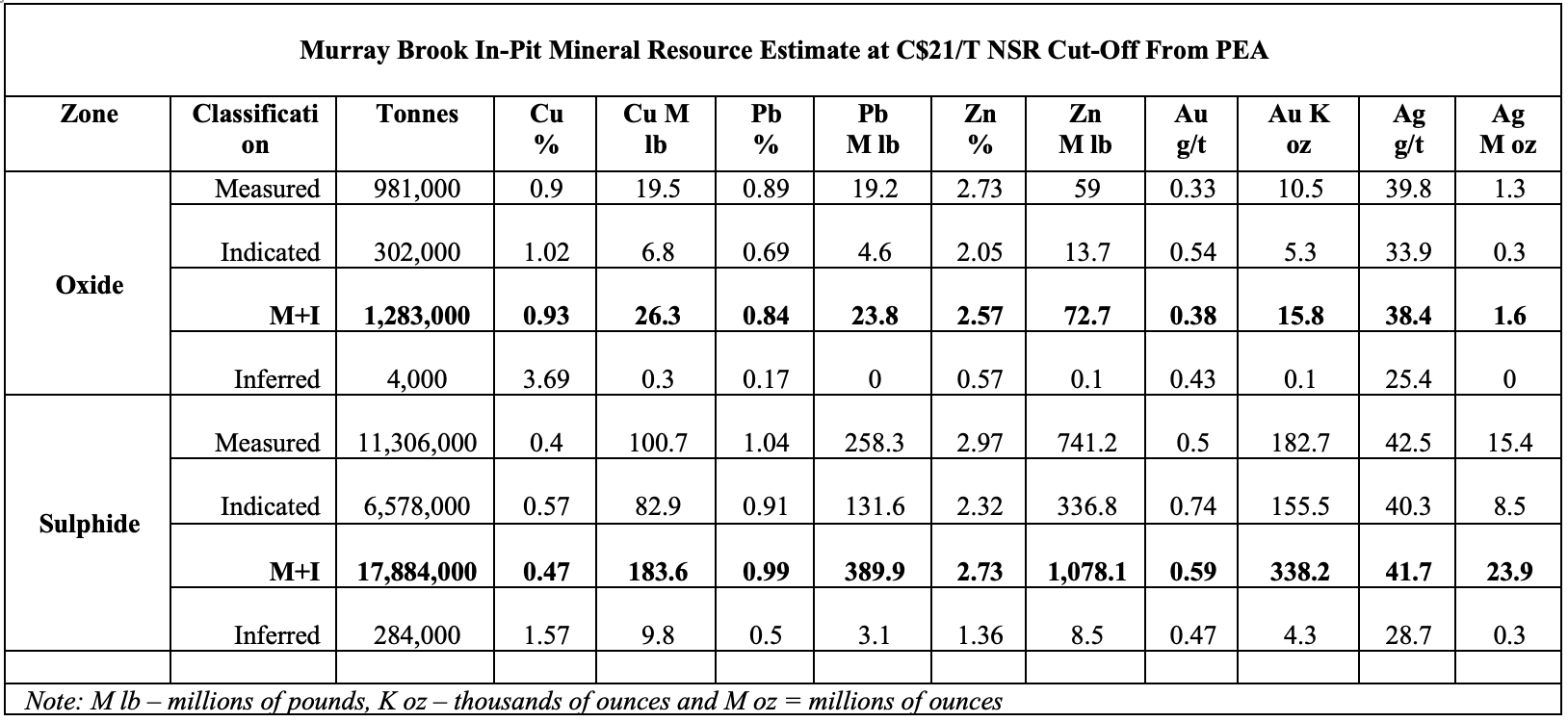

“Our objective to secure majority ownership of the Murray Brook deposit has been central to our growth strategy since 2022. This potential acquisition of a large, advanced-stage polymetallic asset is transformative for Canadian Copper. This considered transaction would firmly establish the Company’s footprint as a base metal explorer with significant mineral resources in the Bathurst Camp. The Murray Brook deposit contains 183 million pounds of copper, 1.07 billion pounds of zinc, 390 million pounds of lead, 42 million ounces of silver, and 339,000 ounces of gold,” commented Simon Quick, CEO of Canadian Copper.

“This compliments our current Chester asset very well with estimated Measured Resources totaling 120 million pounds of copper. This opportunity enables possible synergies with the Chester deposit through the implementation of hub and spoke processing. Several deposits in the region extend beyond 1,000 meters in depth, thus we are excited to test the vertical depth extent of Murray Brook beyond the previously explored 350 meters.” he added.

With the exception of the information included under the heading “Value Creation Opportunities: Integrate Scoping Studies and Update Project Economics”, all technical information concerning the Murray Brook project in this press release has been derived from the “Technical Report and Preliminary Economic Assessment (PEA) of the Murray Brook Project New Brunswick Canada” with an effective date of June 4, 2013 prepared by P&E Mining Consultants Inc, under the supervision of Eugene Puritch, P. Eng., for Votorantim Metals Canada Inc. and El Nino Ventures Inc. and filed on www.sedar.com (the “Murray Brook Technical Report and PEA”).

Canadian Copper is not treating the “historical resources estimate” as a “current resources estimate” or “mineral reserves”, as it has not taken steps to identify what work is required to verify, upgrade or re-classify the “historical resources estimate” using a qualified person. Company believes the historical resource estimates to be both relevant and reliable. The information provides an indication of the exploration potential of Murray Brook but may not be representative of expected results.

The strategic merits of this transaction for Canadian Copper shareholders are:

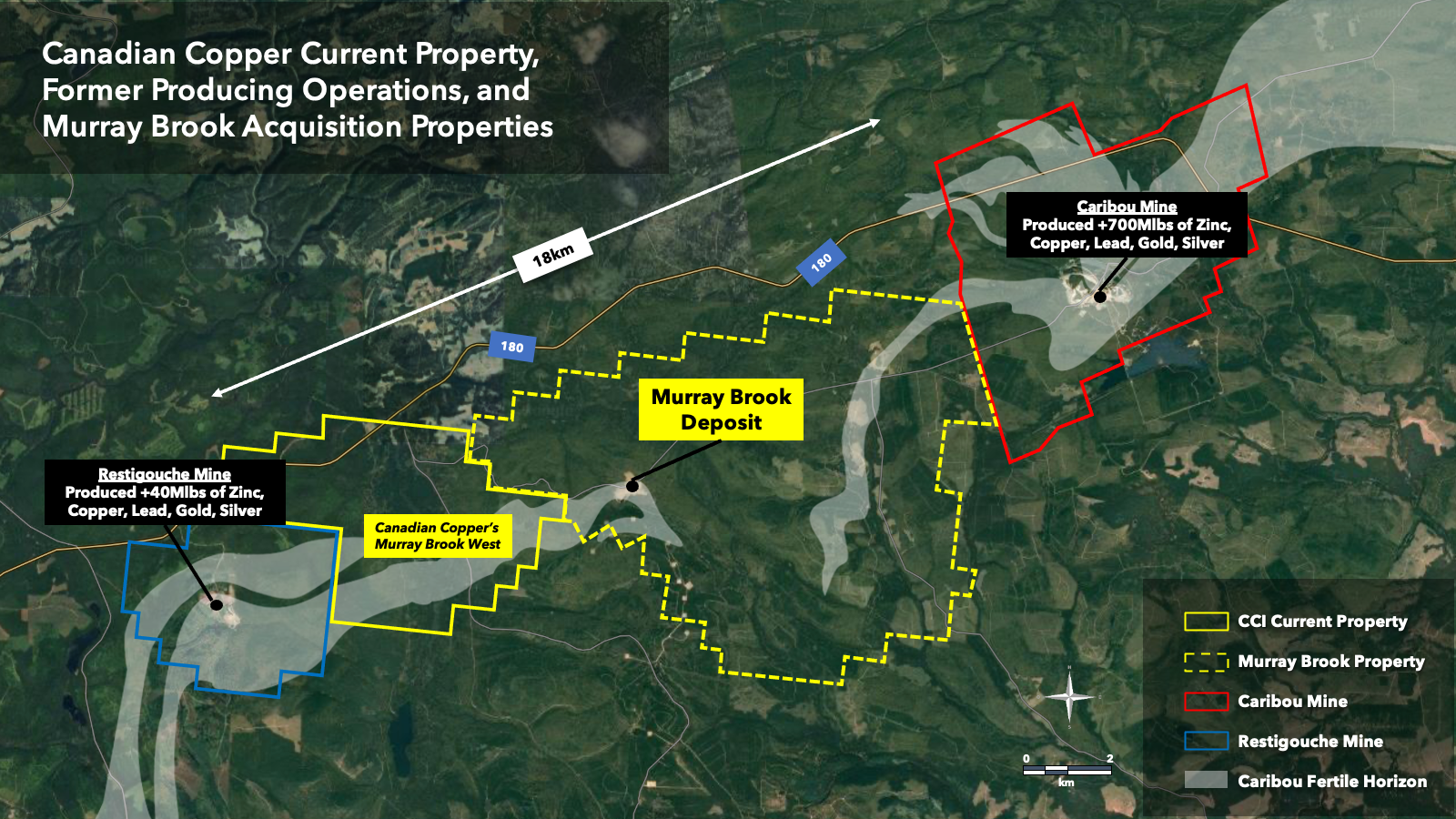

- Location synergies: The consolidation of the Company’s ownership across 18 km’s of the Caribou Horizon trend connecting our Murray Brook West exploration asset to the west, and Murray Brook deposit to the east (see Figure A). These assets connect the previous operating Restigouche and Caribou Mine’s which produced have more than 700 million pounds of zinc plus copper, lead, and other precious metals since 1970. The Caribou Mine remains equipped with an operating process plant including milling, flotation, and a tailings storage facility.

- Strategic Asset: The completion of this transaction would result in Canadian Copper owning a majority in an advanced-stage, large, undeveloped 18Mt volcanogenic massive sulphide (“VMS”) potentially open pit mineable deposit with significant near-mine and prospective regional exploration. More than 98% of the Murray Brook mineral resources are within the Measured and Indicated categories.

- Mineral Resources Description: The Murray Brook deposit contains a sulphide Measured and Indicated Mineral Resource of 18 million tonnes grading 0.47% Cu, 2.73% Zn, 0.99% Pb, 42 g/t Ag, and 0.59 g/t Au. The contained metal within this Mineral Resource is approximately 183 million pounds of copper, 1.07 billion pounds of zinc, 390 million pounds of lead, 42 million ounces of silver, and 339,000 ounces of gold.

- Development Optionality: The expanded mineral resource base provides scale to study a central hub and spoke processing strategy or toll milling with other assets in the region.

- Maintain Focus in a Top Tier Jurisdiction: This transaction provides continued focus on critical minerals in New Brunswick, a jurisdiction with demonstrated regulatory and permitting framework for asset development.

Transaction Detail

The Company and Seller have agreed to the following considerations under the LOI signed February 13, 2023, which is subject to exchange approvals, and the execution of a definitive purchase agreement (“PA”). For additional acquisition details, please click here.

- A C$250,000 deposit paid to Seller upon expiration of Right of First Refusal. (Condition satisfied)

- A C$750,000 installment to be paid by the Company to the Seller upon PA execution.

- The issuance of 2,000,000 units of Canadian Copper. Each unit to consist of one common share priced using the 30-day volume-weighted average price (“VWAP”) ending on the closing date of the PA (“Unit Price”) with a twelve month hold period, and one full warrant exercisable for five years at an exercise price that is a 50% premium to the Unit Price.

- A 0.25% net smelter return (“NSR”) royalty on the MB asset. 50% of NSR can be repurchased by the Company for C$1.0 M. The NSR has a zinc price sliding scale defined as: <US$1.50/lb = 0.25%, US$1.50-1.59/lb = 0.50%, US$1.59-1.68/lb = 0.75%, >US$1.68/lb = 1%.

- The replacement of the Seller’s bond provided to the Government of New Brunswick totaling C$2,000,000 within three months of closing the transaction.

- A final installment of C$2,000,000 to be paid by the Company to the Seller within 31 days of commercial production.

After the Company satisfies conditions #1-5, Canadian Copper will have completed its purchase of a 72% interest in the MB Joint Venture, and the minority partner will retain the remaining 28% interest. The joint-venture agreement (“JVA”) stipulates that the minority party contribute its proportionate share for expenditures or be diluted. There is no minority party dilution provision where their interest converts to an NSR.

Large Historical Mineral Resource with Thick Drill Intersections

The Murray Brook deposit is the 5th[1] largest VMS deposit within the Bathurst Camp, which ranks 3rd globally as a major VMS district. Murray Brook has a historical resource estimate prepared in accordance with the requirements of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The Measured and Indicated Mineral Resource is 18 million tonnes grading 0.47% Cu, 2.73% Zn, 0.99% Pb, 42 g/t Ag, and 0.59 g/t Au. The contained copper and zinc metal within this Mineral Resource is approximately 210 million pounds of copper and 1.15 billion pounds of zinc. The open pit Mineral Resource is summarized below in Table A.

The mineralization forms a coherent massive sulphide deposit hosted within a sheath fold; enveloped by chlorite-sericite alteration as a halo. There are two distinct lenses to the deposit; a western lens which is deeper and zinc-rich and an eastern lens that is shallower and copper-rich with some zinc. The bottom of the deposit is approximately 350 meters below surface.

Examples of the higher-grade thick intervals are, for additional results please click here:

- MB-2011-49: intersected 148 meters from 32 meters grading 0.61% Cu, 3.82% Zn, 0.63 g/t Au, and 56 g/t Ag.

- MB-2012-138: intersected 44 meters from 182 meters grading 0.18% Cu, 8.49% Zn, 4.58%

- Pb, 0.59 g/t Au, and 152 g/t Ag.

- MB-2017-01: intersected 53 meters from 27 meters grading 5.8% Zn, 2.8% Pb, 1.05 g/t Au and 77 g/t Ag.

Table A: Murray Brook Historical Resource Estimate*

*Murray Brook Technical Report and PEA

Canadian Copper is not treating the “historical resources estimate” as a “current resources estimate” or “mineral reserves”, as it has not taken steps to identify what work is required to verify, upgrade or re-classify the “historical resources estimate” using a qualified person.

Value Creation Opportunities: Integrate Scoping Studies and Update Project Economics

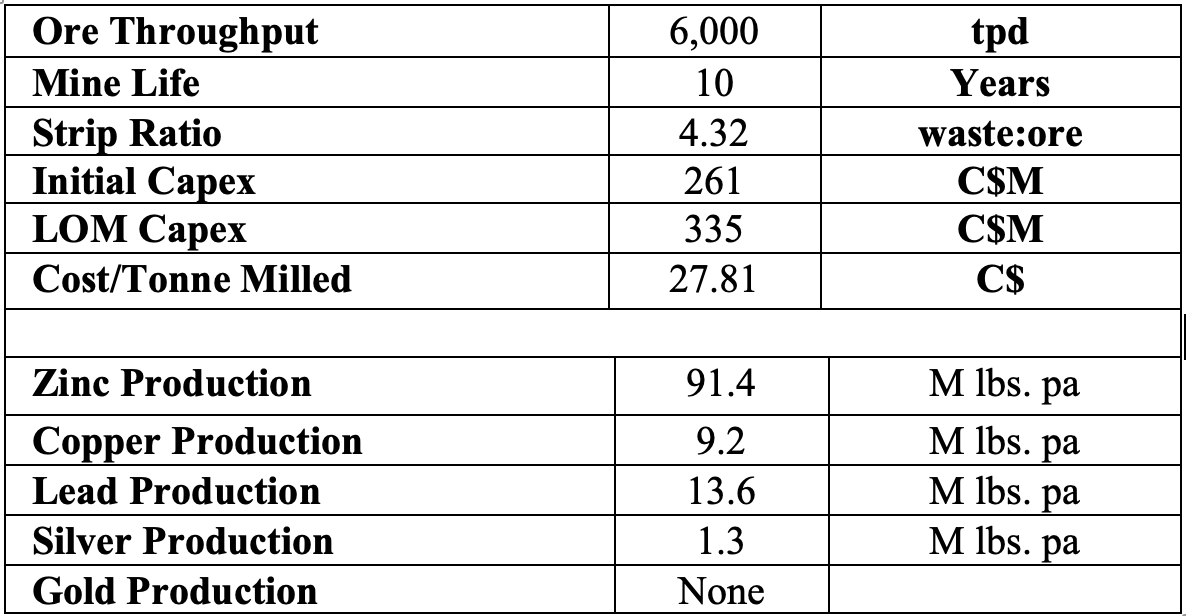

The Murray Brook Technical Report and PEA was completed on Murray Brook in 2013. The operating metrics and financial summary from that report are presented below in Table A. Exploration work and project advancements have occurred at Murray Brook since the Murray Brook Technical Report and PEA, that when incorporated into a new PEA, could improve the project economics, such as:

- Additional metallurgical testwork was completed in 2019 that yielded significantly higher metal recoveries than previously included in 2013 PEA, principally through increases in copper and lead recovery.

- Project de-risking engineering in key areas such as geotechnical drilling and analysis, ground water modeling, pit slope stability design, and acid base accounting analysis to support material handling for reclamation design purposes.

- A new copper stringer zone discovery which is 25 meters outside of the known open pit mineralization that could increase the current 10-year mine life[2]. The information provides an indication of the exploration potential of Murray Brook but may not be representative of expected results.

- Several targets identified both near-mine and more than 10 km from the known Murray Brook deposit.

- Evaluate ore sorting. This has material economic benefits to reduce transportation costs, emissions, reduced energy consumption, and tailings storage requirements.

Table B: Murray Brook July 2013 PEA Summary

The Murray Brook Technical Report and PEA is preliminary in nature and its mineable tonnage includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the preliminary assessment will be realized.

Figure A: Property Location

Please click here for larger version

1 https://www.northernminer.com/news/el-nino-ventures-posts-new-resource-in-new-brunswick/1000961181/

2 “Puma Exploration Discovers a New Copper Zone at Murray Brook” posted on GlobalNewswire on April 10, 2019 by Puma Exploration Inc.

Qualified Persons

Mr. Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc. and independent Qualified Person as defined in NI 43-101, has reviewed and approved the scientific and technical content of this news release.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. The Company is focused on the prolific Bathurst Mining Camp (BMC) of New Brunswick, Canada. There are currently 70,555,000 shares issued and outstanding in the Company.